This week I am musing about money! In fact I have been musing about money for a few months now. The trigger was watching ZACH & JODY GRAY on CREATIVE LIVE and they kept banging on about this guy called DAVE RAMSAY who changed their lives. They said it enough times that I decided it was time for a little bit of investigation.

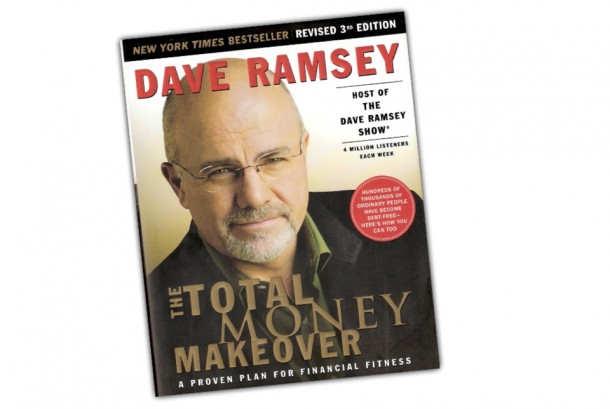

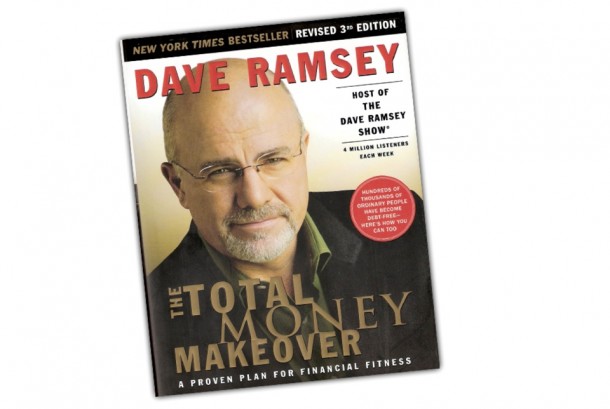

I bought The Total Money Make Over for my Kindle and got half way through and decided to purchase the audio book too. I love a good audio book for times when I am doing retouching work or a lot of Lightroom image processing. It helps to pass the time and gain knowledge simultaneously. Multitasking at its best.

The concepts are fairly simple and easy to follow. Since following Dave Ramsey’s Baby Steps for the past few months I have recently exceeded Baby Step 3: “Save 3 to 6 months of expenses” as an Emergency Fund. I can tell you it feels great! This is so important for those of us who run our own businesses. It is amazing that when you put your mind to something it really can be achieved. What constitutes an emergency are things like loosing income, the car packing up, an unexpected pregnancy… that sort of thing. Not a holiday to the South of France or a new floaty white cotton summer top from Monsoon.

Now, I will admit that we had it easier than a lot of people out there because we started with no dept. In Baby Step 2: “Pay off all debt using the Debt Snowball” Dave recommends getting rid of all consumer debt, credit cards and student loans. I can imagine that this must be super difficult for some people but he does explain how to do it starting with the smallest debt and working your way through to the biggest one at the end.

Baby Step 1: “Save a £1000 Emergency Fund” super fast is the one that really gets you into it. Stop everything and just concentrate on this one alone. It can be done very quickly. It’s the step that builds momentum and motivation to begin with steps 2 and 3.

Baby Step 4: Invest 15% of your income into retirement is the next on the list for us and again DAVE RAMSAY has some valuable recommendations on where to actually put this money and how to spread it out.

Baby step 6:”Pay off your house early” is the one that made my ears prick up and got me all excited. I felt like somebody had shaken me out of a coma! It always seemed like some sort of an impossible dream to be living in a paid off property. If I could find the guy who advised us on a {very!} long term mortgage I would slap him around the head with a wet fish! Dave recommends never getting more than a 15 year mortgage (when you are ready and can afford to). I had a play around with the SANTANDER MORTGAGE CALCULATOR and couldn’t believe the results I was being fed back. The fact is that the monthly payments really are not that much more for a 15 year vs a 25 year mortgage. Depending on what you can afford to pay you could even look at 7 to 10 years. Upon discovering this I felt like opening up the window and screaming “Why did nobody tell me this!!!???” Why did the mortgage adviser harp on about the monthly payments and not properly explain how interest works and how we could in fact pay the mortgage off a lot earlier. Well, let me tell you that I am so glad I found this out now and not 20 years from now!

Something that I never really understood properly was that if you are paying say £500 in interest per month based on a yearly interest rate percentage and you are paying say £200 towards the capital, the interest payment of 500 remains the same whether you are paying for 10 years or 25 years. So if you pay a bank £500 in interest for 25 years you can see very clearly that it will cost you a hell of a lot more than if you only had to pay them £500 for only 10 years and pay more towards the capital and therefore pay off your mortgage a lot sooner. That is a saving of £90 000 in interest that you would have paid to the bank! Crazy.

Some of you may be reading this thinking that it is so obvious, but let me tell you that a good few people I have spoken to are just as confused as I was about all of this.

Baby Step 7: “Build Wealth and Give” is truly and exciting prospect and I just know we can do it and so can you!